- VA loan applications require documents that verify service, identity, income and financial stability.

- Most VA borrowers begin with basics like pay stubs, W-2s, bank statements and a COE, with additional items requested as needed.

- Preparing key documents early helps prevent delays during the loan process.

There are several documents required for a VA home loan application, but fortunately, advancements in technology and automation have made the process significantly smoother. That said, there are still a few documents you may need to have access to while applying.

If you’re unsure what documents you need, take a look at our VA loan document checklist below.

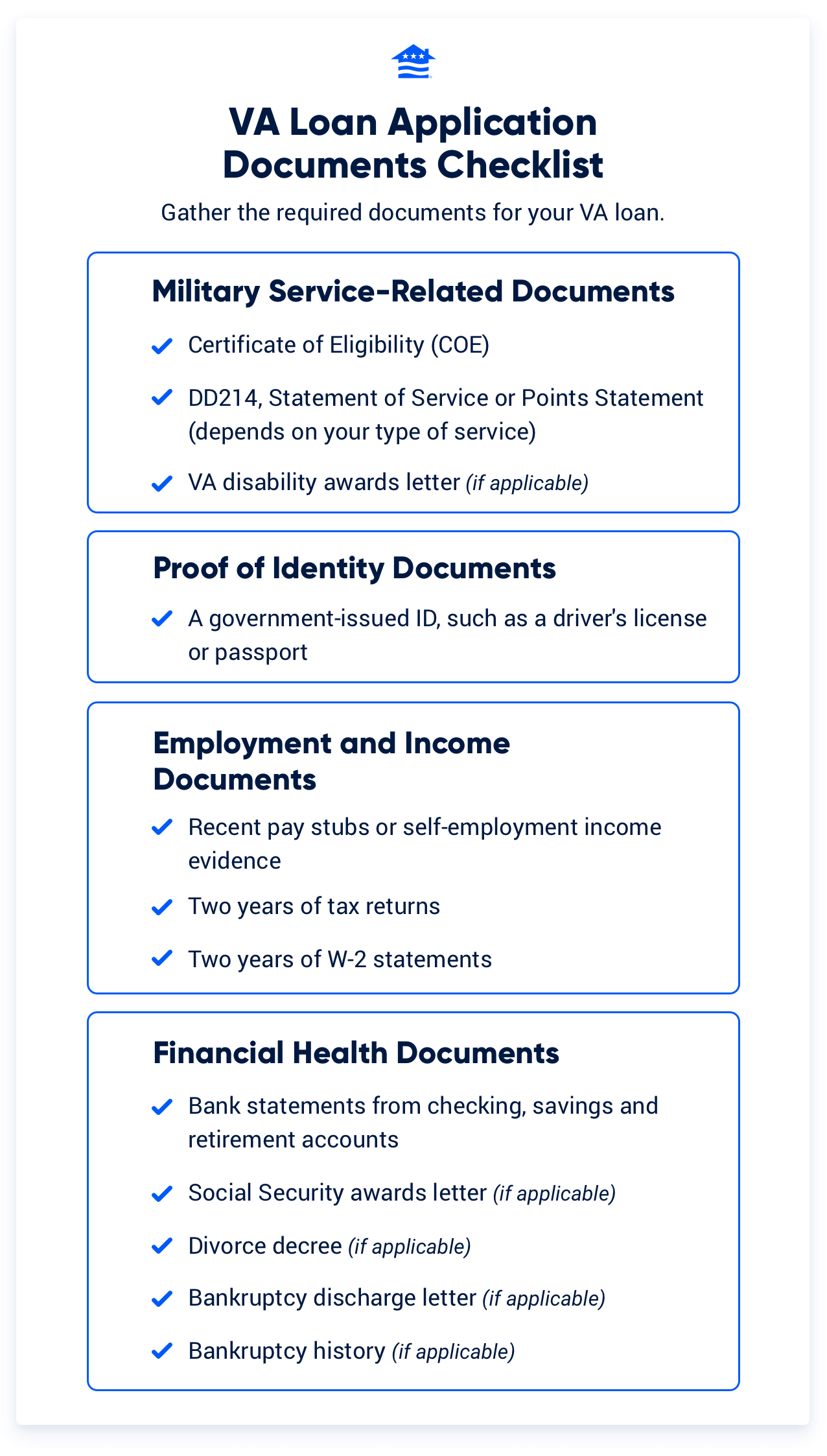

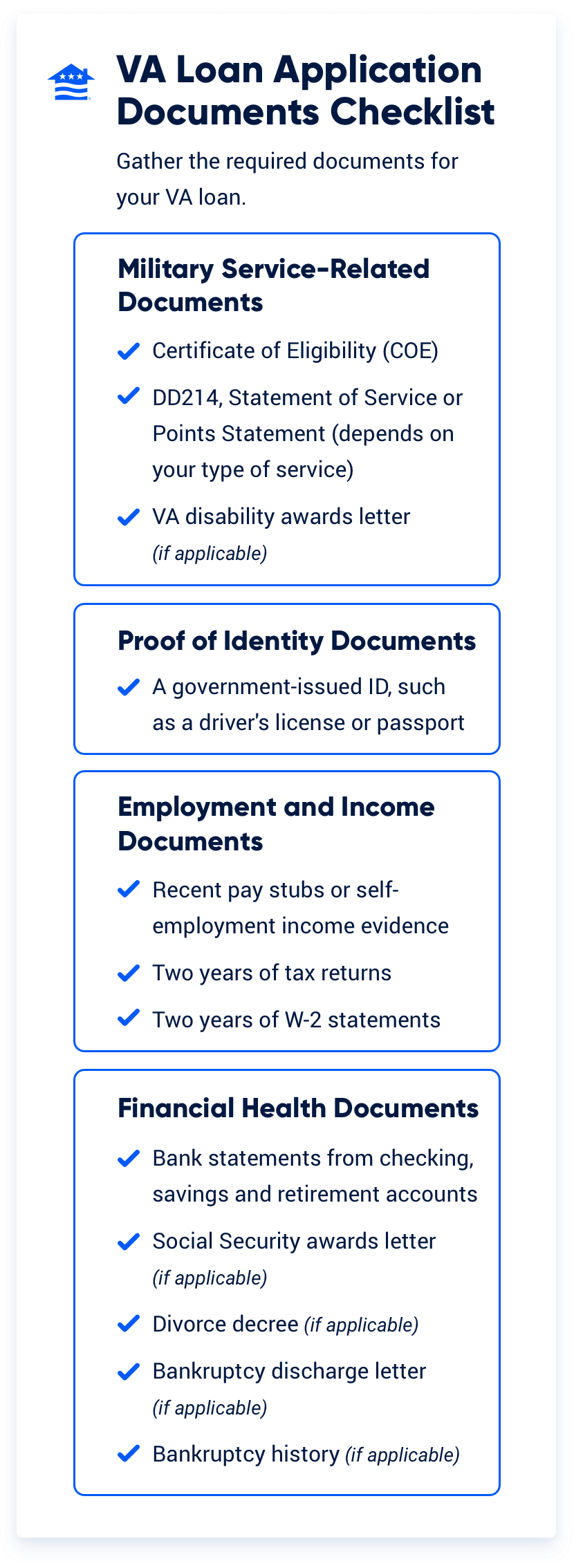

VA Loan Document Checklist

Every borrower’s income, employment and service history is different. For example, self-employed borrowers might need to provide more documentation than Veterans receiving standard W-2 income.

Here’s a checklist of VA loan documents and the information that may be part of your application:

You won’t need to provide every document all at once. Most borrowers start with the basics, such as W-2s, recent pay stubs and bank statements. As your application moves forward, your lender may ask for additional paperwork such as explanation letters, tax returns or other income documentation. The good news is that most of these documents are now available and can be easily submitted online.

Now that you've got a good idea of which documents you need for a VA loan, let's get into the specifics.

Military Service-Related Documents

You may need to gather your military service-related documents. As part of the VA loan application process, lenders will want to see that you’ve met all the necessary service-related requirements.

Certificate of Eligibility (COE)

One of the most important documents you need for a VA loan is your Certificate of Eligibility. Your COE verifies that you meet the military service requirements for a VA loan.

The easiest way to get a COE is to go directly to your VA-approved lender. Lenders with VA experience, including Veterans United, are often able to pull your COE for you, saving you the extra step. You can also apply online through the VA's portal or via mail with Form 26-1880.

DD214 Form

A DD214 Form or Certificate of Release or Discharge From Active Duty is a document you receive once you leave your military duty. You may need it to obtain the Certificate of Eligibility.

Some lenders may ask surviving spouses to obtain the deceased Veteran's DD214 form to speed up their application process.

National Guard and Reserve Veterans now receive Form DD214 and Form DD214-1 (Reserve Component Addendum) when discharged. These two documents help simplify the VA application process by providing a complete record of a Reservist’s or National Guard member’s active and inactive service, character of service at final discharge and retirement points earned.

Members who were discharged before the new documentation may need to obtain the NGB Form 22 in addition to their retirement points statement.

Disability Award Letter (if applicable)

VA disability compensation is a tax-free benefit paid to Veterans with injuries or illnesses that occurred during active duty. If you are a recipient of disability compensation, you will need to provide a VA disability compensation letter to prove this, as it will help when it comes to verifying your income or employment status for a VA loan.

W-2 Statements

VA lenders don’t just like to look at the here and now when it comes to your income; they also like to see a solid employment history. Having a few years at the same company is ideal, but a good history of employment is key no matter where you’ve worked.

VA underwriting focuses on income stability and likelihood of continuance when reviewing income documentation.

Short breaks, like a couple of weeks between jobs, are usually considered normal and won’t be an issue. Longer gaps, such as several months without income, may require a letter of explanation.

Be sure to gather your military W-2s from the last two years, as lenders typically require this to verify your employment history.

Financial Health Documents

The following documents are to prove your current financial health, beyond your income status.

Recent Banking Statements

Lenders need to know what your month-to-month spending behavior is like, so you will need to provide bank statements. VA lenders will want to look at your assets and make sure you're in a healthy financial position to afford a mortgage and the expenses that can come with homeownership.

Most lenders will require your most recent two months of bank statements, though some may ask for more depending on your situation.

Bankruptcy History

If you have ever filed for bankruptcy or lost property to foreclosure, your lenders need to know. Bankruptcy history doesn’t necessarily mean you won’t ever be able to get a VA loan, but VA lenders will need to be made aware of this. Having all of that paperwork handy upfront can help save some time down the road.

Credit Reports

Your lender will pull your credit report directly as part of the application process. You don't need to provide this yourself, but it's helpful to review your own credit beforehand to check for any errors or issues that might need addressing.

It Pays to Be Prepared

It may seem like a lot of paperwork, but preparing these documents ahead of time will make the VA loan process easier.

In some cases, you might not need all of the above documents to start the loan process. But not having them if your lender requests them can lead to huge delays. For help with paperwork requirements and information, connect with a Veterans United VA loan expert.

Answer a few questions below to speak with a specialist about what your military service has earned you.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Feb 16, 2026

Written ByChris Birk

Reviewed ByDon Wilson

Updated document count from 13 to 12 and expanded explanations for clarity on each item. Article reviewed and fact checked by underwriter Don Wilson.

Related Posts

-

What is the VA Seller Concession Rule?Seller concessions with a VA home loan can save Veteran homebuyers thousands of dollars, but cannot exceed 4% of the loan.

What is the VA Seller Concession Rule?Seller concessions with a VA home loan can save Veteran homebuyers thousands of dollars, but cannot exceed 4% of the loan. -

VA Loan Discount PointsPurchasing discount points on a VA loan can be a good investment for Veterans looking to lower their interest rate.

VA Loan Discount PointsPurchasing discount points on a VA loan can be a good investment for Veterans looking to lower their interest rate.